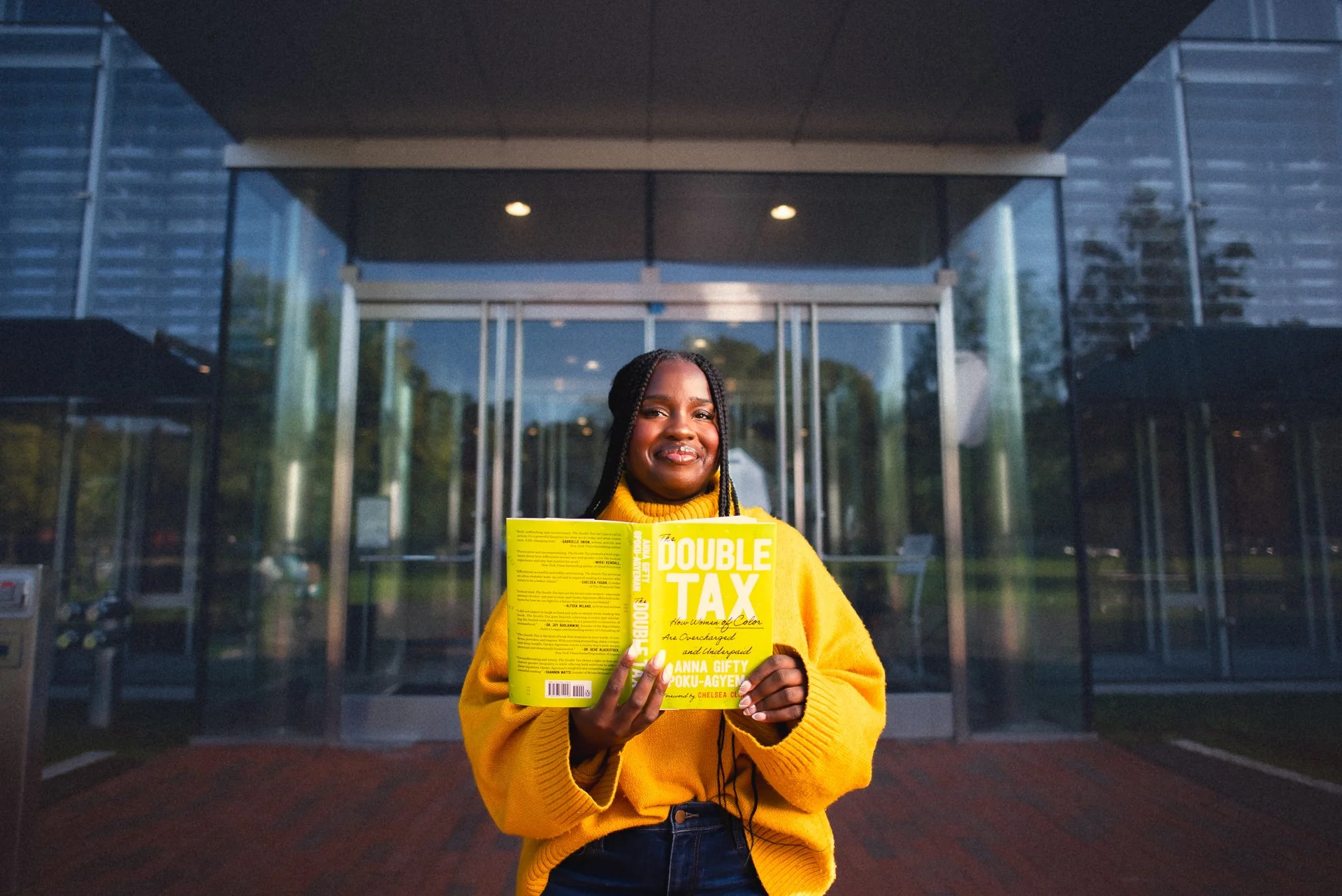

Why is it so expensive to be a woman of color in America? Anna Gifty breaks it down.

Anna Gifty Opoku-Agyeman is an award-winning Ghanaian-American researcher and writer. She is a doctoral student at Harvard Kennedy School studying public policy and economics, and is the youngest recipient for a CEDAW Women’s Rights Award by the United Nations Convention on the Elimination of All Forms of Discrimination Against Women.

In her new book, The Double Tax, Anna asks why it’s so expensive to be a woman of color in America and shows us that it doesn’t have to be this way. Throughout the book, Anna reveals that women spend more money, time, and effort than men across areas like beauty, motherhood, and career, and that Black and white women lead vastly different lives.

FEMINIST sat down with Anna to learn more about The Double Tax:

Anna Gifty Opoku-Agyeman is an award-winning Ghanaian-American researcher and writer. She is a postgraduate student at Harvard Kennedy School studying public policy and economics and the youngest recipient for a CEDAW Women's Rights Award by the United Nations Convention on the Elimination of All Forms of Discrimination Against Women. In 2025, she published The Double Tax: How Women of Color are Overcharged and Underpaid, which has since received coverage from Marketplace, The New York Times, Forbes, Black Enterprise, and Sirius XM Radio. Her first book, The Black Agenda, received widespread coverage from outlets like NPR, ESSENCE, TELEMUNDO, and The New York Times.

What does feminism mean to you?

First and foremost, thank you so much FEMINIST for having me again! To me, feminism, at its core, is about women from all walks of life and backgrounds basking in freedom and liberation—AND that freedom and liberation we experience unlocking the best society has to offer.

Congratulations on officially becoming a published author with your new book, The Double Tax! For readers new to your book, how would you define the "double tax," and why is it so central to understanding the economic realities women of color face in America?

THANK YOU! This is such a labor of love and one of the best group projects I've ever been a part of. The Double Tax is the compounded cost of racism and sexism, and the book discusses how these costs define the lives women lead, especially women of color, across major life milestones such as motherhood, career, retirement, and so forth, and why it’s incumbent on ALL of us to rid our world of these costs.

I also think the book is helpful in understanding the current political and economic moment because it provides evidence for why everybody loses when we ignore the individual costs women of color face because of racism and sexism.

The double tax feels especially urgent right now, with over 300,000 Black women leaving the workforce and ongoing economic pressures. How do you see your book speaking to this current moment?

The Double Tax argues that Black women, in the good times, experience barriers in the workplace along career choice and career path. We are more likely to be in jobs that pay us less and have worse benefits. Simultaneously, in high-paying career paths, we experience the highest turnover, lowest promotion rate, and are the most likely group to be labeled low performers.

What happens then when there are targeted cuts toward the federal workforce—where Black women are overrepresented—and sectors like DEI because of the political environment?

We will see a mass exit of Black women from the workforce as we’ve now seen with 318,000 Black women “leaving” their jobs between February and June 2025 according to Katica Roy. And what people are beginning to realize is that these job losses Black women are experiencing have societal consequences. 318,000 Black women include taxpayers, mothers, breadwinners, highly educated individuals, and members of our society. When people lose the source of income, they lose their source of making a living and because Black women oftentimes are who their communities rely on, entire towns, states, and our country stands to lose from our absence from the labor force. Had we taken note, maybe we would be having a conversation about how to prevent a deeper crisis from forming.

What are some of the most significant costs that make it so expensive to be a woman in America—and how do those costs escalate for Black women and other women of color?

Childcare: The Center for American Progress (CAP) reports that, on average, childcare options in 2021 cost at least $889 per month, depending on the care option, or roughly $16,000 per year on average.

If we really consider that price point, and how inflation impacts how far our dollars go over time, then childcare is making up a big share of a family's income even today and that is burdening families across the board. And for Black families and families of color, because we have less familial income at the median, that burden is just made far worse.

Wealth Building: I was shocked to learn that while white women have 78 cents of wealth for every dollar white men have, Black women have 8 cents of wealth for every dollar of wealth white men have. When considering this, it became clear why we're among the least likely to own our homes. We don't have the wells of wealth to draw from, and the pathways to building wealth are that much harder because of where the double tax shows up along our journey.

Lack of Promotion: So for every 100 men promoted, according to the Women in the Workplace report by Lean In and McKinsey, only 54 Black women are promoted, and we are the least likely group among all women's groups to be promoted into managerial positions. And I think about this question: Who defines the picture of leadership in America and beyond, and what happens when a Black woman wants to rise to the challenge of being a leader? And that's where the glass cliff phenomenon comes in, where Black women are oftentimes promoted when there's a crisis—and that crisis means that if we fail, we take the blame, and if we succeed, we get none of the credit.

Many of us understand what it means to be underpaid, but your book emphasizes how women of color are also systematically overcharged. Can you break down what those hidden costs look like in everyday life?

I think when it comes to being overcharged, these hidden costs include Black women having to pay more to exist and women of color in particular having to pay more to exist, and I see this in beauty. I see this in even the fact that we have to spend more money as women on our homes, but if you're a Black woman or a woman of color, you're having to deal with the frictions of the housing market in other ways, and so that might result in more charges because people don't think you deserve to live in that house or in that neighborhood. I see it in childcare, where what is considered a second mortgage is making up a bigger chunk of Black women's income because of how little income we have. The Double Tax is literally in every aspect of our lives.

What do you believe are some concrete ways individuals and communities can start dismantling the double tax right now?

To begin dismantling the double tax, we must take individual, collective, and political action, and I think that those three things work in tandem with one another.

For individual action, I think we can personally advocate for better conditions alongside our peers, our friends, our family, our neighborhood. We can say, "Hey, I think there should be more beauty products here that cater to the entire neighborhood," or "Hey, I think there should be a baby changing station here so that mothers are better accommodated in the workplace."

On the collective action front, I think that people need to join their local unions, talk more openly about how much they're getting paid and the conditions of their promotions in the workplace, and support each other during the caregiving experience (motherhood and otherwise). I think a lot of times we are so individualistic in Western society, whereas a lot of other societies understand that it takes a literal village to take care of ourselves and the people we love. Relying on one another is the only way we’re going to get through this and that’s what every solution in this book ultimately points to.

Finally, I would say that we need to hold all the people in power more accountable across every level of leadership and this includes your local school board or your workplace employee resource group. I think what we should be asking right now are our leaders pushing policies forward that address the double tax at all? If not, we have every right to challenge them to do so.

What do you hope readers will take away from The Double Tax and carry with them after finishing the book?

I think what I want people to take away from reading this book is that either we all win or we all lose—there is no world in which Black women and women of color lose and you win. So either we're all on the same page about that, or we continue to suffer under the circumstances that we are currently in. And… this book is funny, hopeful, and informative! I hope that comes through when you pick up your copy.